Here today, gone tomorrow. Many employees see their employer as a kind of temporary life partner. If something better comes along, then they move on. Trips abroad, continuing education or the birth of children also often cause women to leave their jobs or sharply reduce their working hours. This means high recruiting costs for companies and the periodic loss of know-how and well-established personal relationships.

Both sides often forget that the connection to the employer is not only a temporary one; in fact, in the form of the occupational retirement provision it lasts a lifetime. At every stage of their professional lives, employees take an important piece of their future with them: their pension fund savings, on which they will one day live as retired persons. Smart employers therefore offer their employees good retirement provision and make an effort to actively inform them about it. In doing so, they create a bond that extends into the future and inspires a high degree of loyalty.

Why women are more likely to have a pension shortfall

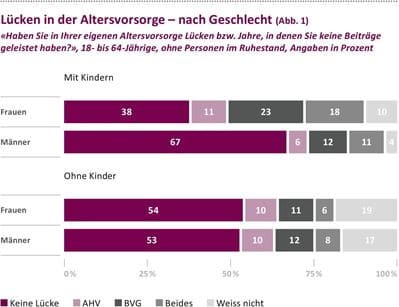

As a new study shows, employers can score points with women in particular. Taking into account that especially mothers more often have shortfalls in their pension provision than men and consequently live with an increased risk of running into financial difficulties after retirement. The reason for this is the different employment biographies, as shown by the new study "Women and retirement provision – better knowledge for equal opportunities" (in German only) commissioned by Zurich Switzerland and the "Geschlechtergerechter" association. Many women continue to reduce or interrupt their employment when they give birth to a child, while for men, fatherhood has a less frequent impact on employment. Accordingly, 40 percent of women report having shortfalls in their mandatory retirement provision, while for men the figure is 30 percent (see chart 1).

In addition, two thirds of women with children would currently not be able to stand on their own two feet with their income alone. For men and women without children, on the other hand, only around one fifth say this (see chart 2).

And those who earn less cannot save as much capital in their retirement provision and are thus more likely to be at risk of a shortfall. In combination with an unplanned life event, such as a separation, disability, or loss of employment, this can lead to a financial shortage in old age. To prevent this, companies can make good offers to their employees on several levels.

1. Stop disadvantages for part-time employees

Companies can reduce or completely abolish the coordination deduction in their occupational retirement provision. This deduction occurs in the calculation of the amount of monthly savings contributions. If the deduction is the same for all employees – regardless of their working hours – it is particularly significant for part-time employees, as it disproportionately reduces the amount of their savings.

2. Offer more than the mandatory

Companies have the possibility to pay savings contributions that are generally higher than the statutory minimum. This allows them to create flexibility in two senses: On the one hand, in the case of extra-mandatory benefits, it is more likely that a temporary reduction in working hours becomes possible without resulting in a problematic shortfall. On the other hand, it opens up the likelihood that employees also pay in more. This is because the law requires a company to pay at least half of the savings contributions. If employees are given the opportunity to make so-called voluntary purchases, they can close any past shortfalls during periods of higher income. It is also important for companies to regularly communicate such offers to employees – those who do good should not forget to talk about it.

3. Save from as early as 18

Companies can optimize the savings process and offer employees the opportunity to save for their pension from the age of 18, even though it is only mandatory from the age of 24. If employees start saving earlier, they either receive a higher pension later or can reduce the percentages in the meantime without this having too much of an impact.

4. Introduce optional savings plans

Companies can offer what are called optional savings plans: An optional savings plan is comprised of two additional savings plans that the company can offer to employees. This not only encourages your employees to make additional savings, but also offers them a larger scope when it comes to shaping their retirement provision.

5. Attracting men to part-time work

Finally, companies can generally position themselves as modern employers and also enable men to work part-time. This can prevent women from having to give up their job or greatly reduce their workload immediately after giving birth. This keeps valuable know-how within the company, and the amount of savings for retirement provision is more evenly balanced between genders.

6. Do good and talk about it

If companies make such offers, they should also talk about them, of course, and show their employees what the employer is doing for their future, as well as what the employees themselves can do to ensure their financial security after retirement. Getting to grips with the Swiss pension system and investment mechanisms in general helps them to improve their financial literacy and gain confidence in their own expertise. It is best for employers to address the issue of retirement provision during the employment interview and also provide regular information afterwards.

Women in particular can benefit from this information: Those interviewed for the study stated they lack the necessary investment expertise far more frequently than men, which is probably why women are more inclined to invest their savings conservatively. While as many as 48 percent of men invest their savings with a focus on returns, the figure for women is only 32 percent. Women are therefore more likely to opt for financial products that focus on preserving the value of their savings.

7. Educate about opportunities in the market

Unlike with equities, this means their money is not exposed to regular fluctuations in value. However, since there has been hardly any interest in recent years and money is currently devaluing quickly due to record high inflation, the money in savings accounts is actually losing value at the moment. The situation is different for equities: Even if the value of shares can fluctuate sharply in some cases and crises occur in between, they have returned significantly better than other asset classes over a period of around ten years or more in the vast majority of phases. Hence the longer it takes for a person to retire, the greater the equity component of private savings – for example, those in the third pillar – should be.

To illustrate: If a person aged between 30 to 60 saves 2,000 francs every year and invests this in an investment fund with a 3.5 percent return, the assets will grow to almost double that amount in the 30 years, in other words 106,860 francs. In a savings account at 1 percent interest, around 73,000 francs would accrue. (Source: own calculation)

If women receive good information from employers about their retirement provision and see that, for example, their retirement provision foundation also invests in equities, they may be more willing to invest privately in a more return-oriented manner with a long investment horizon. If they do so, they will probably thank themselves after retirement.

Flexible retirement provision solutions for today’s working world

If you want to offer modern ways of working, you need an occupational pension plan to match. With Vita, you can flexibly tailor your pension planning solution to the needs of your company. This is how fair play works in occupational retirement provision.

Frequently asked questions

Frequently asked questions

How can I strengthen my employees’ financial expertise?

First and foremost, by making occupational retirement provision a topic of discussion in your company and providing information about it. Vita offers you various tools for this purpose:

- The first step is to ensure that your employees understand how the Swiss pension system works. Those with general financial and investment knowledge also have better knowledge about the three-pillar system. Conversely, you can contribute to greater financial literacy by ensuring that your employees know and understand the principle of Swiss retirement provision.

- The pension certificate contains all relevant information relating to occupational retirement provision and shows what benefits employees and their dependents are likely to receive in old age, in the event of disability and in the event of death. By explaining the pension certificate to your employees, you make them aware of the financial situation that awaits them in old age.

- If you want first-hand knowledge or have specific questions, our retirement provision experts will come by your office and inform your staff about the basics of the social security schemes. To arrange this, simply order the Vita Mobil.

How can I help part-time employees to save more for retirement?

As an employer, there are various ways you can increase your part-time employees’ occupational pension capital.

- Insure a higher portion of salary: You can voluntarily waive the coordination deduction or adjust it to the part-time working hours. This helps women in particular to minimize their pension shortfall.

- Pay in higher contributions: As an employer, you are legally obliged to pay at least half of the contributions into the pension fund. If you pay more voluntarily – for example 60 percent – you ensure that your employees have more net money in their wallets at the end of the month.

- Optimize the savings process and start earlier: To give employees the opportunity to build up higher retirement savings capital in the second pillar, you can offer them savings from the age of 18, for example. The earlier the savings process starts, the higher the retirement pension will be. It may also be worthwhile increasing benefits beyond the legally required minimum – for example, through higher annual savings contributions or an improvement in risk benefits.

- Offer optional savings plans: An optional savings plan is comprised of two additional savings plans that the company can offer to employees. This not only encourages your employees to make additional savings, but also offers them more scope when it comes to shaping their retirement provision.